Group health insurance plans offer medical coverage to members of an organization or employees of a company. They may also provide supplemental health plans—such as dental, vision, and pharmacy—separately or as a bundle. Risk is spread across the insured population, which allows the insurer to charge low premiums. And members enjoy low-cost insurance, which protects them from unexpected costs arising from medical events. Health maintenance organization — These health insurance plans require enrolled patients to receive all their care from a specific group of providers . The plan may require your primary care doctor to make a referral before you can receive specialty care.

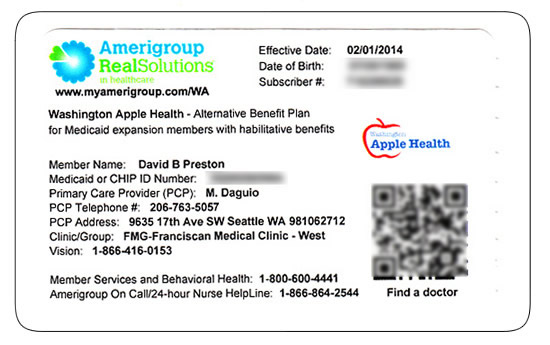

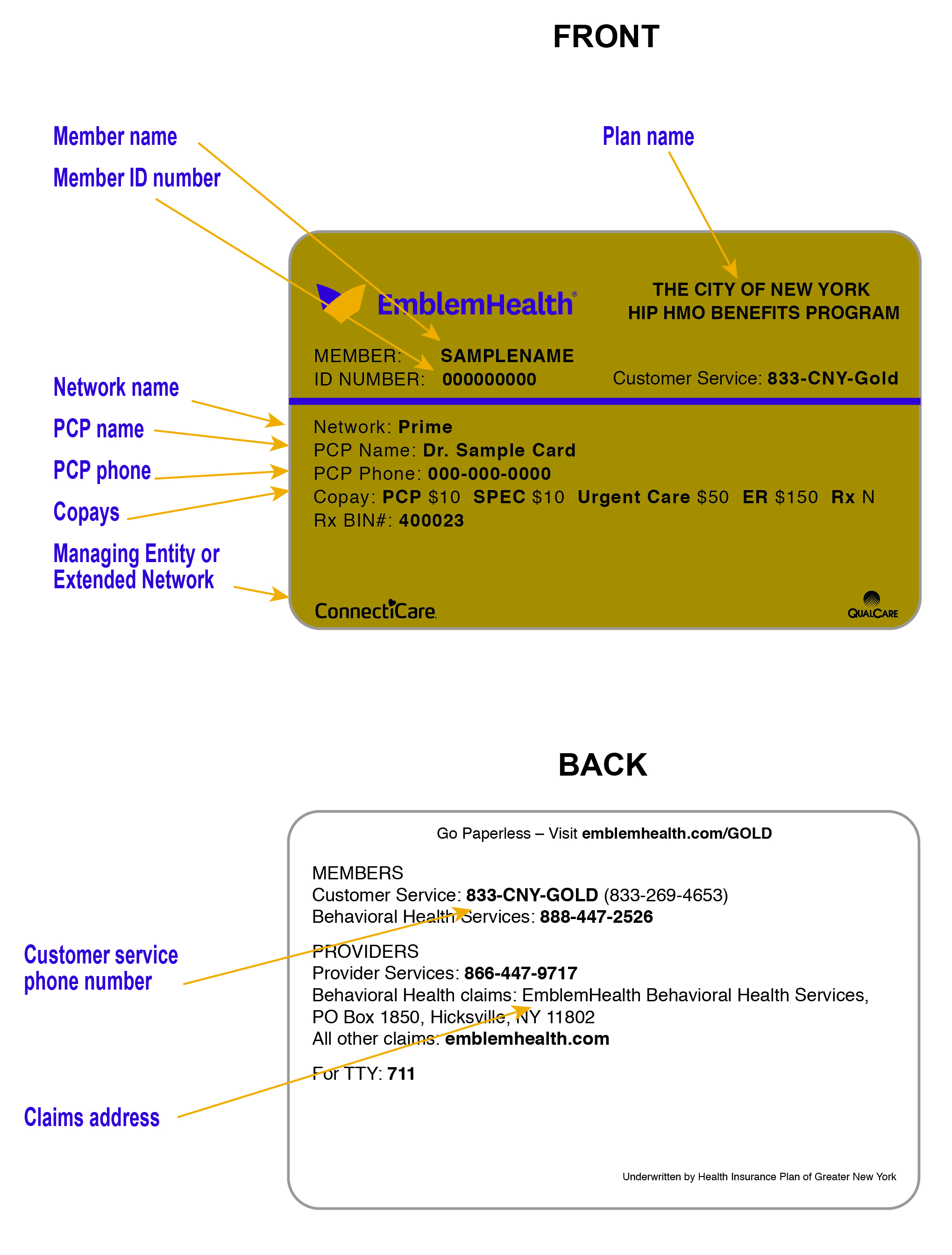

An HMO may require you to live or work in its service area to be eligible for coverage. HMOs often provide integrated care and focus on prevention and wellness. Each person covered by a health insurance plan has a unique ID number that allows healthcare providers and their staff to verify coverage and arrange payment for services. It's also the number health insurers use to look up specific members and answer questions about claims and benefits. If you're the policyholder, the last two digits in your number might be 00, while others on the policy might have numbers ending in 01, 02, etc.

It is no secret that employees' value benefits of group health insurance. However, as premium costs escalate and claim procedure being stringent; employee health insurance has become a tight rope walk in India. We at PolicyBazaar introduce a wide gamut of group health insurance policy products to help you in choosing best corporate insurance plans that will suit both parties i.e. employers and employees. Blending the entire service right from expert advisory, purchase assistance and policy renewal in one package, PolicyBazaar works towards making insurance process easy and convenient. A group of doctors, hospitals and other healthcare providers preferred and contracted with your insurance company. You will receive maximum benefits if you receive care from in-network providers.

Depending on your insurance plan, your benefits may be reduced or not covered at all if you receive services from providers who are not in network. Finally, you might see a dollar amount, such as $10 or $25. This is usually the amount of your co-payment, or "co-pay." A co-pay is a set amount you pay for a certain type of care or medicine. Some health insurance plans do not have co-pays, but many do.

If you see several dollar amounts, they might be for different types of care, such as office visits, specialty care, urgent care, and emergency room care. If you see 2 different amounts, you might have different co-pays for doctors in your insurance company's network and outside the network. These days more and more companies are becoming employee-centric and corporate health insurance has emerged as one of the most preferred benefits to lure new talent.

It plays a crucial role in influencing the psychology of an employee. It makes him feel part of a company and thus, it curtails employee attrition rate and unrest in labor unions. Moreover, it increases their productivity which increases profitability of a business. Special insurance schemes where families are also covered for benefits make employees faithful towards their employers.

Moreover, by offering coverage to your employees, you become eligible to get tax deductions under Income Tax Act. So group or Corporate health insurance policy is a win-win situation for both employees and employers. MEWAs provide coverage to employees of multiple employers in the same line of business. The North Carolina Department of Insurance licenses and regulates these "Multiple Employer Welfare Arrangements" as it does insurance companies. Health care providers in your network receive full payment from your insurance company for the agreed-upon rate for your health care services. The rate your providers receive includes your insurer's share of the cost as well as your share of the cost.

Most patients pay their share of health care costs in a copayment, deductible, or coinsurance. Under M+C plans, patients receive medical services without additional out-of-pocket costs. If you do not see your coverage amounts and co-pays on your health insurance card, call your insurance company . Ask what your coverage amounts and co-pays are, and find out if you have different amounts and co-pays for different doctors and other health care providers. Many group policies provide the option of covering dependent family members. Employers may require eligible employees to satisfy a waiting period of up to 90 days prior to being added to the plan.

As the policyholder, the employer does not need the consent of plan participants to change insurance companies, make changes to the plan, or agree to new premiums or benefits. However, North Carolina law requires employers to provide at least 45 days' notice to their employees when they plan to cease offering health insurance. The amount you must pay after your insurance has paid its portion, according to your Benefit Contract.

In many health plans, patients must pay for a portion of the allowed amount. For instance, if the plan pays 70% of the allowed amount, the patient pays the remaining 30%. An insurance plan that has contracts with health care providers for discounted charges. Typically, the plan offers significantly better benefits and lower costs to the patients for services received from preferred providers.

Many health insurance cards show the amount you will pay (your out-of-pocket costs) for common visits to your primary care physician , specialists, urgent care, and the emergency department. If you see two numbers, the first is your cost when you see an in-network provider, and the second—usually higher—is your cost when you see an out-of-network provider. For example, when you're referred to a specific specialist or sent to a specific hospital, they may not be in your insurer's network.

MultiPlan does not offer insurance, does not administer benefit plans, and does not pay claims to the doctors or facilities in our network. In some cases, your health insurance company can give you a list of comparable, in-network health care providers and services. Group health insurance plans are one of the most affordable types of health insurance plans available. Because risk is spread among insured persons, premiums are considerably lower than traditional individual health insurance plans. This is possible because the insurer assumes less risk as more people participate in the plan. For employees who ordinarily would not be able to afford individual health insurance, it is an attractive benefit.

A doctor, hospital, or other health care entity that is not part of an insurance plan's network. For medical services rendered by non-participating provider, the patient may be responsible for payment in full or higher costs. Many insurance cards list the specific amount that you are responsible for paying for the medical services you are receiving.

Sometimes employers may offer Health Savings Accounts to employees. HSAs are savings funds that allow you to pay some health care costs with tax-free dollars. HSAs let you pay for current medical expenses and save for future qualified medical and retiree health expenses on a tax-free basis.

To use a health savings account, you must also have a high-deductible health plan to use with it. Under a high-deductible health plan, the monthly premium is usually lower, but you are responsible for more out of pocket health care costs that can be paid with pre-tax HSA funds. In North Carolina, large employer groups are those with more than 50 eligible employees. In addition, large group premium rates usually are developed using employer groups past claims history.

Once a large group plan is issued, the group plan will have guaranteed renewal rights. Your insurance plan may require multiple copays, higher deductibles, and coinsurance. You can learn the details of your policy by visiting your insurance company's web site or contacting its customer/member services department.

The back of your insurance card should include the phone numbers and Web site addresses you'll need. For this reason, Summit Health recommends that you learn the specifics of your plan before upcoming health care visits. A federal law that protects employees and their families in certain situations by allowing them to keep their existing health insurance for a specified amount of time.

COBRA provides certain former employees, retirees, spouses, former spouses and dependent children the right to temporary continuation of health coverage at group rates. The individual must pay the premium cost to keep his/her insurance plan, but the costs are usually less expensive than individual health coverage. Employer-sponsored group health insurance plans first emerged in the 1940s as a way for employers to attract employees when wartime legislation mandated flattened wages.

This was a popular tax-free benefit which employers continued to offer after the war's end, but it failed to address the needs of retirees and other non-working adults. Federal efforts to provide coverage to those groups led to the Social Security Amendments of 1965, which laid the foundation for Medicare and Medicaid. Group health insurance plans are purchased by companies and organizations and then offered to their members or employees.

Plans can only be purchased by groups, which means individuals cannot purchase coverage through these plans. Plans usually require at least 70% participation in the plan to be valid. Because of the many differences—insurers, plan types, costs, and terms and conditions—between plans, no two are ever the same. A medical insurance policy, also called as health insurance, covers medical expenses for illnesses or injuries. It reimburses your bills or pays the medical care provider directly on your behalf. A comprehensive medical insurance covers the cost of hospitalisation, daycare procedures, medical care at home , ambulance charges, amongst others.

Through your health plan you have access to providers in our networks, but we do not administer your plan or maintain information regarding your insurance. A healthcare organization that covers a greater amount of the healthcare costs if a patient uses the services of a provider on their preferred provider list. Some PPOs require people to choose a primary care doctor who will coordinate care and arrange referrals to specialists when needed. Other PPOs allow patients to choose specialists on their own.

A PPO may offer lower levels of coverage for care given by doctors and other healthcare professionals not affiliated with the PPO. The most money you will have to pay before your insurance company covers all costs. Once that limit is reached, the plan will pay 100% of the allowed amount for eligible charges for the rest of the calendar year. Some insurance companies do not include certain costs in this limit, such as fertility treatments or prescription drugs. Other insurance companies increase the out-of-pocket maximum for care provided by out-of-network providers. Policy Number - a number that the insurance company assigns the patient to identify the contract for coverage.

A doctor, hospital, or other health care entity that is part of an insurance plan's network. They agree to accept insurance payment for covered medical services as payment in full, less any patient liability. A group of doctors, hospitals, and other health care providers that have a contract with an insurance plan to provide services to its patients. If you have health insurance through work, your insurance card probably has a group plan number.

The insurance company uses this number to identify your employer's health insurance policy. Your insurance company may provide out-of-area coverage through a different health care provider network. If so, the name of that network will likely be on your insurance card. This is the network you'll want to seek out if you need access to healthcare while you're away on vacation, or out of town on a business trip.

A group health insurance plan provides medical coverage for a group of people. The amount a patient pays before the insurance plan pays anything. In most cases, deductibles apply per person per calendar year. With preferred provider organizations , deductibles usually apply to all services, including lab tests, hospital stays and clinic or doctor's office visits. Some insurance plans waive the deductible for office visits.

A member ID number and group number allow healthcare providers to verify your coverage and file insurance claims for health care services. It also helps UnitedHealthcare advocates answer questions about benefits and claims. The "coverage amount" tells you how much of your treatment costs the insurance company will pay.

This information might be on the front of your insurance card. It is usually listed by percent, such as 10 percent, 25 percent, or 50 percent. For example, if you see 4 different percent amounts, they could be for office visits, specialty care, urgent care, and emergency room care. There is a $450 plan year deductible for some services provided outside UHS. SHIP members are responsible for the first $450 of qualified charges outside of UHS each plan year.

Once the deductible has been satisfied, SHIP insurance coverage resumes. In-network medical and mental health office visits, emergency room visits, network urgent care center visits and prescriptions are not subject to the annual deductible. University Health Services is a complete outpatient health center for students, providing medical, mental health and preventive care. Our clinicians serve as your primary care provider or "PCP" while you're at UC Berkeley.

All eligible registered students may use the services of UHS, regardless of what type of major medical insurance they have. Services are supported by registration fees and are provided at moderate prices. Fully insured group health insurance policies are offered by licensed insurance companies. The insurance company collects premiums and uses the money collected to pay claims.

If this occurs, the Association provides up to $300,000 per person to cover unpaid claims. A high deductible health plan with a health savings account provides medical coverage and a tax-free way to save for future medical expenses. Once the deductible has been met, eligible healthcare expenses will be covered by the plan. Government-sponsored health plans continue to provide care to those left out of employer-sponsored group health insurance plans.